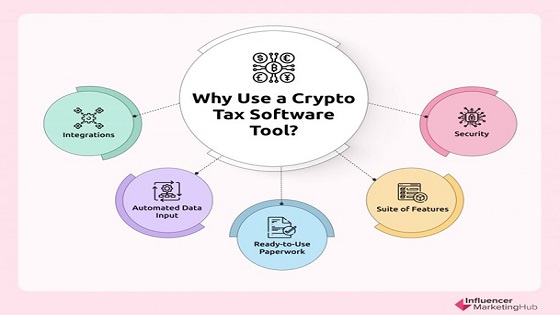

U.S. financial backers are focusing harder on revealing duties on digital money. With 16% of the grown-up populace putting resources into cryptographic forms of money, and this market expected to develop enormously, the U.S. government has sloped up its endeavours to get its cut of the pie. The IRS originally drafted its digital money charge rules back in 2014, and Washington has since given the IRS one more $80 billion to track and catch charge dodgers.

Notwithstanding, crypto charges aren’t difficult to make sense of. Doing them accurately frequently includes detailing complex exchanges from across an enormous number of crypto stages. You want the right programming to get it right without hugely “burdening” yourself.

Be that as it may, how would you pick the right programming? In this first portion, we discuss how you can dependably crunch the entirety of your information. All through this series, we’ll frame each of the crates your product needs to tick to make ascertaining your crypto charges basic and precise. Use the Coupon Code of TokenTax.

Take a look at Compatibility With Crypto Platforms.

The basic initial phase in documenting your digital currency charges through charge announcing programming is to gather and import your exchange information from across numerous trades and wallets. This interaction might look direct, yet there are a few fundamental advances you want to take to guarantee precision.

First, check the number of crypto trades and wallets the product upholds. Cointelli, for instance, upholds an impressively bigger number of major crypto trades than numerous different contenders — with full import capacities. Instances of trades upheld by Cointelli incorporate significant ones, such as Coinbase, Binance, and KuCoin, yet incorporate a large number of the more speciality trades. To add to this, Cointelli likewise includes support for somewhere around 15 blockchains, including significant ones like Bitcoin, Ethereum, and even Dogecoin.

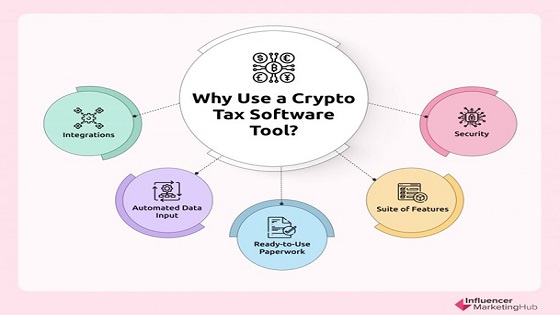

CSV File Import Test Results

Green: Supported | Pink: Not Fully Functional | Red: Not Supported

Second, you want to check whether the product upholds different approaches to bringing in exchange information from each trade. Any other way, you will not have the option to import your exchanges naturally. You will rather need to go through the unwieldy course of transferring them utilizing the structures given by the product — assuming that any are even accessible.

You should check how simple every stage makes it to recover and import your exchange information since each trade and wallet gives different bringing-in techniques incorporating CSV and API. Certain crypto charge programming arrangements struggle appropriately to bring in information from CSV documents and API keys. Sometimes, the arrangement is inconsistent, or qualifications can’t be verified as expected.

Cointelli not just offers support for additional wallets and trades yet, in addition, gives the least demanding strategies for bringing in exchange information from across these stages. This makes Cointelli extremely simple to use for beginners.

Affirm Data Loss Resolution Capabilities

Third, you ought to know about the information misfortune that might happen while bringing exchange information into the crypto charge programming. There are many digital forms of money and many digital money exchange types worldwide (for example, purchase, sell, cashback, premium). Notwithstanding, the images for digital currencies can differ across trades. For instance, Bitcoin can be set apart as BTC in certain stages but XBT in others. Most cryptographic money charge programming stages overlook seldom utilized exchange types while bringing in exchange information. This implies that a little information might escape everyone’s notice, prompting clients to record expense forms with basic data missing.

Fourth, before bringing them in, you ought to check whether exchange records for fresher digital currencies and things like NFTs have been transferred appropriately. New digital currencies and related things are constantly arising, and trades, wallets, and crypto charge programming need an opportunity to get up to speed.

At last, you should check whether you can erase imported information as the need might arise. Without appropriately sifting through these pieces of undesirable information, you might wind up paying more assessment than you need to. Financial backers with many exchanges, specifically, are encouraged to give close consideration to the sum they wind up paying. To expand the precision of charge estimation, Cointelli separates expense values by taking apart the trade information across key models instead of utilizing the information given by the trade for what it’s worth.

Following stages?

After you’ve affirmed that your crypto charge programming of the decision can appropriately import all your information from across your trades and wallets, now is the ideal time to check whether the product allows you to survey the information and make amendments on a case-by-case basis. We’ll see you in the following article where we cover definitively that!

Peruse parts two and three of the series here.

Cointelli is a crypto charge detailing organization established by Mark Kang, a confirmed expense proficient whose long experience serving his local area as a CPA spurred him to foster easy-to-use charge programming. Cointelli naturally identifies and revises mistakes during the duty report age process and is viable with TurboTax and a wide scope of crypto trades and wallets. In these ways, and that’s just the beginning, Cointelli carries simplicity to the duty detailing process.

Disclaimer: This post is for enlightening purposes and ought not to be deciphered or depended upon as a substitute for the appeal of monetary, legitimate, or charge experts. This content addresses the U.S. government’s annual assessment ramifications for U.S. residents and inhabitants. It doesn’t address charge results that might be pertinent to a specific individual subject to extraordinary standards, like vendors or merchants. You ought to talk with your own monetary, lawful, or charge experts to report and record your crypto expenses or pursue choices on your specific conditions. The substance of this post is likely to change. The regulations, guidelines, or translation of the current regulations could change, which may antagonistically influence either tentatively or retroactively.